Table of Contents

The Altcoin Season Index is a way for you to track the performance of the top altcoins in one place. It’s a tool that can help you decide which altcoins are worth buying, and it also gives you information about past events that occurred during “altcoin season”. The index was created by analyzing data from the last four years and identifying trends in the market. Here’s how it works:

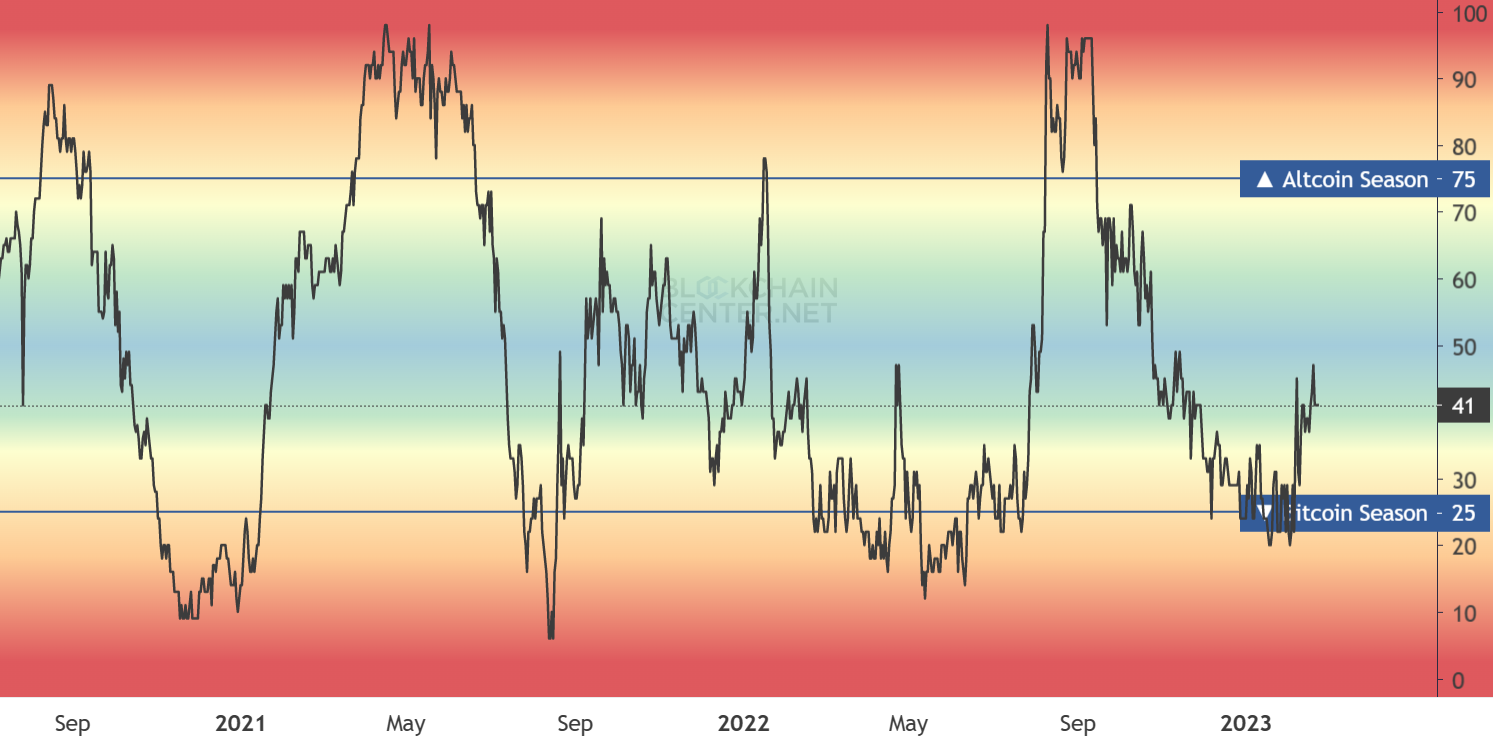

Altcoin Season Index

The Altcoin Season Index (ASI) is a tool that can help you find undervalued altcoins. It’s based on two main factors: the value of Bitcoin and the average daily price of altcoins. The ASI gives you an idea of how much it would cost to buy one unit of each coin, which allows you to compare their relative values.

To calculate this index, we take into account both factors. First, we use historical data from CoinMarketCap to get an average daily price for both Bitcoin and all other coins combined (as well as individual values if they have enough volume). Second, we divide each coin’s market cap by its average daily price; this gives us an indication of how much money needs to be invested in order for someone who has no prior knowledge about cryptocurrencies or blockchain technology at all and just wants some quick profits to acquire one unit from scratch without any external help whatsoever (e.g., exchanges).

The ASI is a fairly simple tool that can help you find undervalued coins. However, it has its limitations: -The average daily price is calculated over the last 2 days (based on the 24h volume), not based on historical data. This means that you cannot compare prices across different exchanges and currencies, as they might have different market caps or volumes;

-The ASI does not take into account the popularity of a coin. For example, Bitcoin is still by far the most popular cryptocurrency in existence, and it will take years for any other token to catch up; -There are many other factors that affect a coin’s price besides its market cap (e.g., transaction speed, scalability).

-The ASI is not designed to be used as a long-term investment strategy. It’s more of a quick way to find undervalued coins.

What is the Altcoin Season Index?

The Altcoin Season Index is a measure of how well altcoins are doing relative to bitcoin.

It’s calculated by taking the price of each altcoin and dividing it by the price of bitcoin. This results in an index number that represents how much each altcoin has risen or fallen compared to BTC over a given period of time (usually 30 days). For example, if you bought $100 worth of Litecoin on July 1st and sold it on August 1st at its current market rate, then your profit would be: ($150 – $100)/$100 = 50%. In this case we would say “the LTC season index was positive 50% during this period.”

This index is useful for traders who want to make sure they are not losing money during a period of bitcoin volatility. It also allows investors to see how altcoins are doing relative to BTC.

The purpose of this index is to show how well altcoins are doing relative to bitcoin. It’s calculated by taking the price of each altcoin and dividing it by the price of bitcoin. This results in an index number that represents how much each altcoin has risen or fallen compared to BTC over a given period of time (usually 30 days). For example, if you bought $100 worth of Litecoin on July 1st and sold it on August 1st at its current market rate, then your profit would be: ($150 – $100)/$100 = 50%.

In this case we would say “the LTC season index was positive 50% during this period.” This index is useful for traders who want to make sure they are not losing money during a period of bitcoin volatility. It also allows investors to see how altcoins are doing relative to BTC.

Bitcoin & Altseason

Bitcoin is the most popular cryptocurrency in the world, but it’s not the only one. Altcoins are an alternative to Bitcoin and generally less expensive than Bitcoin. You can use altcoins as a medium of exchange or store of value depending on what you need them for.

Bitcoin is a store of value whereas altcoins are used as a medium of exchange by investors who want to invest in other cryptocurrencies besides Bitcoin but don’t want to pay its high fees or wait for slow transactions times (which makes it difficult for merchants).Bitcoin and altseason are two concepts related to the cryptocurrency market. Let’s explore each of them:

- Bitcoin: Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin operates on a decentralized network called blockchain, which enables secure and transparent transactions without the need for intermediaries like banks. Bitcoin’s key features include limited supply (21 million coins), decentralization, and the ability to transfer value globally with low transaction fees.

Bitcoin’s price has experienced significant volatility throughout its history. It has seen both rapid increases and steep declines in value. Bitcoin’s price is influenced by various factors, including market demand, regulatory developments, technological advancements, macroeconomic conditions, and investor sentiment.

- Altseason: Altseason, short for “altcoin season,” refers to a period when alternative cryptocurrencies, or altcoins, experience a surge in price and market capitalization relative to Bitcoin. Altcoins are cryptocurrencies other than Bitcoin, such as Ethereum, Ripple, Litecoin, and many others.

Altseason typically occurs when Bitcoin’s price stabilizes or enters a consolidation phase after a significant bull run. During altseason, investors shift their focus from Bitcoin to other cryptocurrencies, seeking higher returns. This results in increased trading volumes, price spikes, and overall market enthusiasm for altcoins.

Several factors can contribute to altseason, including the release of promising projects, increased adoption of blockchain technology, positive regulatory developments, and overall market sentiment. However, it’s important to note that altseasons can be unpredictable and may vary in duration and intensity.

It’s worth mentioning that cryptocurrency markets are highly speculative and subject to risks. Prices can be influenced by various factors, and investing in cryptocurrencies should be approached with caution. It’s important to conduct thorough research, diversify investments, and only risk what you can afford to lose. Consulting with a financial advisor is also recommended before making any investment decisions.

Which altcoins should I have bought?

- Bitcoin. Bitcoin is the granddaddy of cryptocurrencies, so it’s no surprise that most people start their altcoin season with some bitcoin. If you haven’t already bought some, now is a good time to do so, and don’t forget about Litecoin and Ethereum as well!

- Bitcoin Cash: This hard fork from Bitcoin was created in August 2017 as a response to slow transaction times and high fees on the original Bitcoin network. Many investors believe BTC will eventually become centralized due to its popularity among miners (who control much of its hashing power), but BCH has been gaining popularity recently due to its faster transactions and lower fees than BTC.

- Ripple (XRP): XRP is another popular alternative currency that has seen significant growth since its inception in 2012 thanks largely due to partnerships with major financial institutions like MoneyGram International Inc., American Express Co., Western Union Co., Bank of America Corp., Royal Bank of Canada – RY & CO; Toronto-Dominion Bank – TD & CO; Credit Suisse Group AG – CSGKGZVYHUJLQ; HSBC Holdings plc HSBKF, Banking And Financial Services Industry Companies With A Market Capitalization Between $5 Billion And $10 Billion (Europe) Regionally Based On Their Location Of Headquarters Or Other Corporate Headquarters Within Europe Regionally Based On Their Location Of Operations Within Europe Regionally Based On Their Location Of Operations Within Asia Pacific Regionally Based On Their Location Of Operations Within Africa Regionally Based On Their Location Of Operations Within United States Northeast Regional Economy

- Ethereum (ETH): As the second-largest cryptocurrency by market capitalization, Ethereum has established itself as the leading smart contract platform. Its robust infrastructure enables developers to build decentralized applications (dApps) and execute smart contracts. With the ongoing development of Ethereum 2.0, which aims to improve scalability and reduce energy consumption, Ethereum continues to be a compelling investment option.

- Polkadot (DOT): Polkadot is a multi-chain interoperability protocol that facilitates communication and seamless data transfer between different blockchains. Its ecosystem enables the creation of interconnected and specialized blockchains, offering scalability, security, and flexibility. With an experienced team and growing adoption, Polkadot has garnered attention within the blockchain community.

- Chainlink (LINK): Chainlink aims to bridge the gap between smart contracts and real-world data by providing decentralized oracles. These oracles securely fetch and verify data from external sources, enhancing the capabilities and reliability of smart contracts. With its widespread adoption and partnerships with prominent companies, Chainlink has become a significant player in the decentralized oracle space.

- Solana (SOL): Solana is a high-performance blockchain platform designed to handle decentralized applications and scalable smart contracts. Its unique consensus mechanism, Proof of History (PoH), enables fast transaction processing and low fees, making it an attractive choice for developers and users alike. Solana’s recent surge in popularity reflects growing confidence in its technology and potential.

While the altcoin market offers numerous opportunities, selecting the right investments requires careful consideration and research. Factors such as market capitalization, project fundamentals, community engagement, and real-world adoption play crucial roles in identifying promising altcoins. It’s vital to diversify your portfolio, stay informed about market trends, and assess your risk tolerance before making any investment decisions. Remember to seek professional advice tailored to your financial situation and goals. The cryptocurrency market can be volatile, and investments should be made with caution and a long-term perspective.

Learn how you could have made money by investing in altcoins.

The Altcoin Season Index (ASI) is a tool that allows you to make money by investing in altcoins. The ASI measures how many times more profitable it was to invest in an altcoin than bitcoin, based on its market capitalization, the total value of all coins available for trading on an exchange and price volatility over the last month.

If we look at the ASI chart above, we can see that there were three times when it was better to invest in an altcoin than bitcoin: January 2018, April 2018 and October 2018 (so far). If you had invested $100 worth of each coin back then and sold them now (assuming no transaction fees), here’s what your returns would have been:

- $100 worth of BTC would be worth $103 today; this means your investment grew 3% since then. Not bad! But…

- $100 worth of BCH would have grown almost 50%, giving you about $150 altogether after selling off your holdings today! That’s pretty sweet considering it only took 12 months instead of 24 months like with BTC; however…

Ethan Moore, crypto and stock trader since 2012. Co-founder of Blockwatch experts team.