Table of Contents

The American poet Ezra Pound was never short of things to say, especially with regard to economics. While his literary contributions are unmatched, his economic ideas were largely discarded by his contemporaries, especially as he began to lean towards fascism in the latter part of his life.

In this article, we will explore Ezra Pound’s views on money, government and banking. Finally, we will delve into how Ezra’s ideas interact with today’s modern world where cryptocurrencies are becoming more popular.

An introduction to Ezra Pound

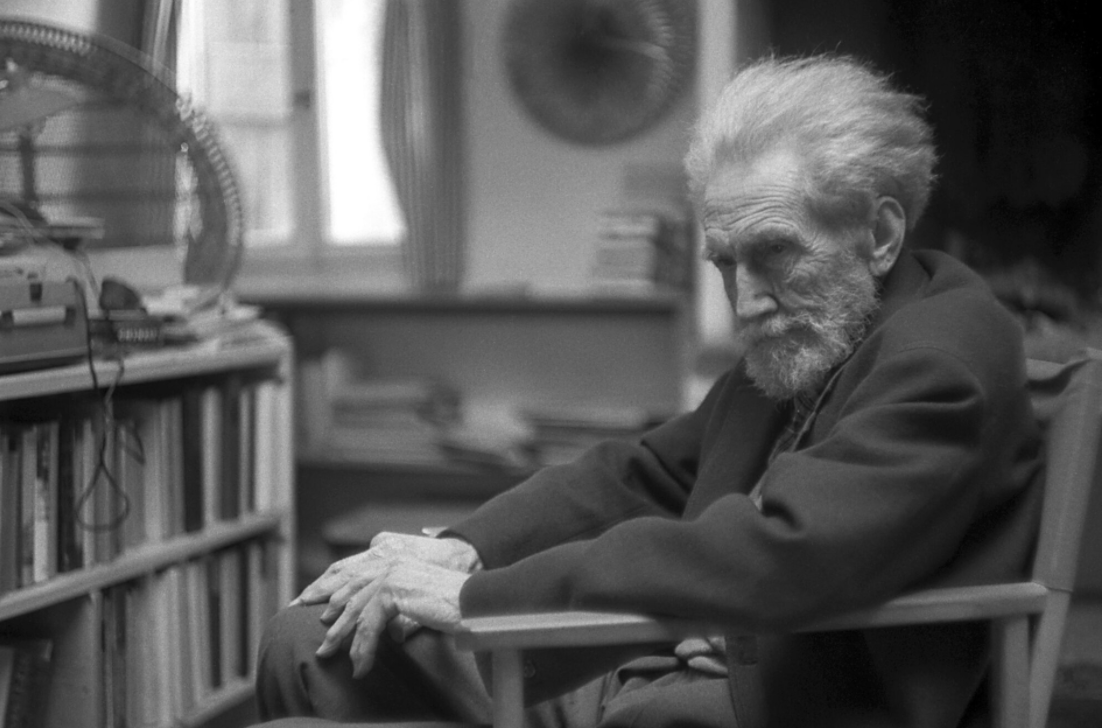

Born on 30 October 1885 in a small town in Idaho, Ezra Weston Loomis Pound came to be one of the most prolific yet controversial figures in American literary history.

Eventually dying in 1972, Pound’s eighty-seven years were composed of innovative literary approaches, earning him accolades and renown. Unfortunately, they also consisted of a significant amount of political troubles, most of which could be attributed to his views on economics and his slow descent into supporting fascist ideology.

As a literary figure, Pound is held in high esteem. Ezra’s approach to poetry was impressively distinct from styles popular at the time, favoring a writing style that was avant-garde and innovative. As a result, he is considered one of the most influential poets of the early 20th century and the father of Modernist poetry.

Playing a pivotal role in the birth of literary styles like Imagism and Vorticism. Pound’s impact was so profound that the 1948 winner of the Nobel prize in literature, prolific author T.S. Eliot stated that Ezra “is more responsible for the 20th-century revolution in poetry than is any other individual.”

In the beginning of his career, Pound was focused on educating the masses. He believed the artistic class had a debt to society, as keepers of culture and morals. In line with his personal dogma, Pound spent much of his early literary career publishing works attempting to introduce laymen to art. Pound’s life work, a long incomplete poem called Cantos written between 1915 and 1962, starts out an aesthetically pleasing work and evolves into a treatise into Pound’s view on economics. Especially, as it pertains to finance capitalism and globalism, and their effects on the public.

This evolution in the Cantos, and other works by Pound, became increasingly evident after the first world war. In “Canto XLV,” Pound took aim at what he believed to be the cause of many of the world’s ills, Usura. He said:

“WITH USURA/ WOOL COMES NOT TO MARKET/ SHEEP BRINGETH NO GAIN WITH USURA”. AT THE END OF THE POEM, IN THAT PECULIAR POUND-ISH STYLE, EZRA DEFINED USURA AS “[A] CHARGE FOR THE USE OF PURCHASING POWER, LEVIED WITHOUT REGARD TO PRODUCTION; OFTEN WITHOUT REGARD TO THE POSSIBILITIES OF PRODUCTION”.

According to Pound, a nation’s wealth should be equal to a combination of its natural resources and labour. This idea is called the Quantity Theory of Money (QTM).

QTM states that money supply and price level in an economy are in direct proportion to one another. A change in the supply of money results in a proportional change in the price level. In this system, the means of production plus labour determine the value and amount of money circulating in an economy.

However, according to Pound, America had been infiltrated by a group of Anglo-American bankers whose sole interest was to leverage the effort of the public in order to turn a profit while simultaneously “diddling” them. Via a number of events, these bankers had come to control the supply of money while simultaneously giving them the power to issue a type of future money called credit. In Pound’s estimation, the control of money should belong to the state, as it was a sovereign power.

Pound believed that the prevailing financial class – an international cabal of Jewish bankers – were stealing from the public and began his descent into fascist ideology.

He explained his views on the contemporary economic systems in place, saying:

“THE TRICK IS SIMPLE. WHENEVER THE ROTHSCHILD AND OTHER GENTS IN THE GOLD BUSINESS HAVE GOLD TO SELL, THEY RAISE THE PRICE. THE PUBLIC IS FOOLED BY PROPAGANDIZING THE DEVALUATION OF THE DOLLAR, OR OTHER MONETARY UNIT ACCORDING TO THE COUNTRY CHOSEN TO BE VICTIMIZED. THE ARGUMENT IS THAT THE HIGH PRICE OF THE MONETARY UNIT IS INJURIOUS TO THE NATION’S COMMERCE. BUT WHEN THE NATION, THAT IS, THE PEOPLE OF THAT NATION OWN THE GOLD AND THE FINANCIERS OWN THE DOLLARS OR OTHER MONETARY UNITS, THE GOLD STANDARD IS RESTORED. THIS RAISES THE VALUE OF THE DOLLAR AND THE CITIZENS OF “RICH” NATIONS, AS WELL AS CITIZENS OF OTHER NATIONS, ARE DIDDLED.”

The people versus power?

“History, as seen by a Monetary Economist, is a continuous struggle between producers and non-producers, and those who try to make a living by inserting a false system of book-keeping between the producers and their just recompense. The usurers act through fraud, falsification, superstitions, habits and, when these methods do not function, they let loose a war. Everything hinges on monopoly, and the particular monopolies hinge around the great illusionistic monetary monopoly,” Pound explained his criticism of the financial class.

Ezra explored a number of ideological responses that could limit the influence and power held by the illusionistic monetary monopoly in sovereign nations.

The state as a defense?

Pound believed that a sovereign nation should take control of its money supply as opposed to outsourcing the issuance and record-keeping of its sovereign notes, as is a popular practice.

He explained that banks were profiting at the expense of the public: “Paterson, the founder of the Bank of England, told his shareholders that they would profit because “the bank hath profit on the interest of all the moneys which it creates out of nothing.” What then is this “money” the banker can create out of nothing”?

Pound campaigned for America’s return to the system where Congress managed the supply of money, prior to the 1913 creation of the Federal Reserve. Pound believed the state would be a better custodian of America’s money.

In his paper, ‘What Is Money For?’, Pound explained:

“STATE AUTHORITY BEHIND THE PRINTED NOTE IS THE BEST MEANS OF ESTABLISHING A JUST AND HONEST CURRENCY. THE CHINESE GRASPED THAT OVER 1,000 YEARS AGO, AS WE CAN SEE FROM THE TANG STATE (NOT BANK) NOTE. SOVEREIGNTY INHERES IN THE RIGHT TO ISSUE MONEY (TICKETS) AND TO DETERMINE THE VALUE THEREOF.”

As Pound explored this idea, along with his anger at the financial class, he began to align himself with more fascist ideas and personalities. Pound delved deeper into antisemitism and fascism, eventually moving to Italy. There, he met with the country’s fascist leader Benito Mussolini and began a series of radio broadcasts that culminated in an arrest and treason charges by the American government.

Pound views on fascism are a study in contradiction, revealing his somewhat unclear understanding and stance of state power. In a letter to Fred Miller, the editor of Blast Magazine, Pound is quoted as saying: “I claim it [fascism] is a factual method; a method practical in a certain time and place against certain inertias; and THEREFORE probably wrong in altro loco, altro tempo” (qtd. in Nicholls 1984: 80). However, in another instance, he reportedly said to Reynolds Packard, while giving a fascist salute : “I believe in Fascism” (qtd. in Doberman 2000: 49).

Proponents of Pound’s ideologies maintain he was never a fascist, rather that he believed that an authoritative state was the last defence any nation had against the international cabal of bankers who sought to defraud them.

Critics, however, argue Ezra’s preoccupation with and digression into economic theory marred his literary genius with fascist and racist ideas. Esteemed literary scholar, Massimo Bacigalupo, even referred to The Cantos as “sacred poem of the Nazi-Fascist millennium” (Bacigalupo 1980: x)

Silvio Gessel as inspiration

In addition to fascist leanings, Pound explored practical tools that states could use to limit the powers of the international financial system. One of the ideas that Pound proposed was Silvio Gesell’s Stamp Scrip.

Gessel was a German-born businessman who had become disillusioned with money after the financial crash of 1890, which left business at a standstill as people hoarded their money. In response to the situation, Gessel proposed a revolutionary idea called Stamp Scrips. In his proposal, money which was saved would have to be periodically stamped at a fee in order to retain its value.

In the new monetary disposition, money would never “rot like potatoes,” reducing the disparity between perishable goods and currency, a nod to the QMT. Moreover, holders of a large number of notes would be discouraged from hoarding them as they would lose their value, in the form of a fee, over time. In this manner, saving via investment of the currency into the production of more value would be incentivized and more economically sound than passive hoarding.

Gesell’s system was largely ignored during his life. But his ideas garnered popularity, spurring on experiments in the Austrian village of Wörgl and in Alberta, Canada. In Wörgl, the experiment proved wildly successful.

The works of Major C.H. Douglas

Another idea Pound held in high esteem was Major Douglas’ Social Credit. Major C.H. Douglas’ wrote three books namely, Social Credit (1918), Economic Democracy (1919), and Credit Power and Democracy (1920), where he outlined his ideas.

The essence of Social Credit a la Major Douglas is to distribute economic and political power by providing those who do the work with the rewards of their labor. In this system, those who did the work accrued the benefits.

What is money for?

In his paper dedicated to economics, ‘What Is Money For’ Pound explained what he believed money to be.

Pound claimed that money to be a means of exchange and a guarantee of future exchange.

Pound defined money as “a measure which the taker hands over when he acquires the goods he takes. And no further formality need occur during the transfer, though sometimes a receipt is given.”

It was also in this paper that he concisely expressed his criticism of international finance stating:

“YOU THINK IT (MONEY) IS A MANTRAP OR A MEANS OF BLEEDING THE PUBLIC, YOU WILL ADMIRE THE BANKING SYSTEM AS RUN BY THE ROTHSCHILDS AND INTERNATIONAL BANKERS. IF YOU THINK IT IS A MEANS OF SWEATING PROFITS OUT OF THE PUBLIC, YOU WILL ADMIRE THE STOCK EXCHANGE. HENCE ULTIMATELY FOR THE SAKE OF KEEPING YOUR IDEAS IN ORDER YOU WILL NEED A FEW PRINCIPLES”.

The principes alluded to by Pound are reflected in this statement from the same work: “THE AIM of a sane and decent economic system is to fix things so that decent people can eat, have clothes and houses up to the limit of available goods.”

Decent people, according to Pound, were those who were not engaging in criminal acts. Thus, a working monetary policy must provide those who create goods with food, shelter, and clothing commensurate to their effort.

Pound on Bitcoin?

Pound believed a working monetary policy should have a strong central authority and redistribution/commensurate compensation of effort.

Meanwhile, Bitcoin (BTC) is not controlled by a central authority.

Instead, Bitcoin is controlled by lines of code that determine the roles of every network participant. Arguably, a better dispensation than being subject to the means of a central authority in the form of fickle state.

Also, while Pound was proposing Stamp Scrip, thus encouraging spending, BTC is deflationary thanks to its hard-coded monetary policy and incentive structure. Finally, those who earn within the Bitcoin ecosystem are those who do the work of validating the transactions. While it is true that large BTC holders can swing the market, the primary method of earning in the Bitcoin network is by adding transactions to the blockchain as a miner.

While Pound’s political views were extremely problematic and his economic views perhaps not fully thought through, his aim was to remove the middleman who – according to him – steals from the public. However, as mentioned above, he believed that the state authority “is the best means of establishing a JUST and HONEST currency.” Meanwhile, Bitcoin aims to remove this authority too, simultaneously increasing the individual’s financial sovereignty.

So, while there’s no way to find out whether Ezra Pound would use Bitcoin, it would definitely grab his attention.

Ethan Moore, crypto and stock trader since 2012. Co-founder of Blockwatch experts team.